With unemployment soaring in America, an estimated 25-43 million people could lose employer-sponsored health coverage. The numbers come from a recent think tank study by the Robert Wood Johnson Foundation (RWJF) and the Urban Institute, and looks at how the COVID-19 recession could affect coverage.

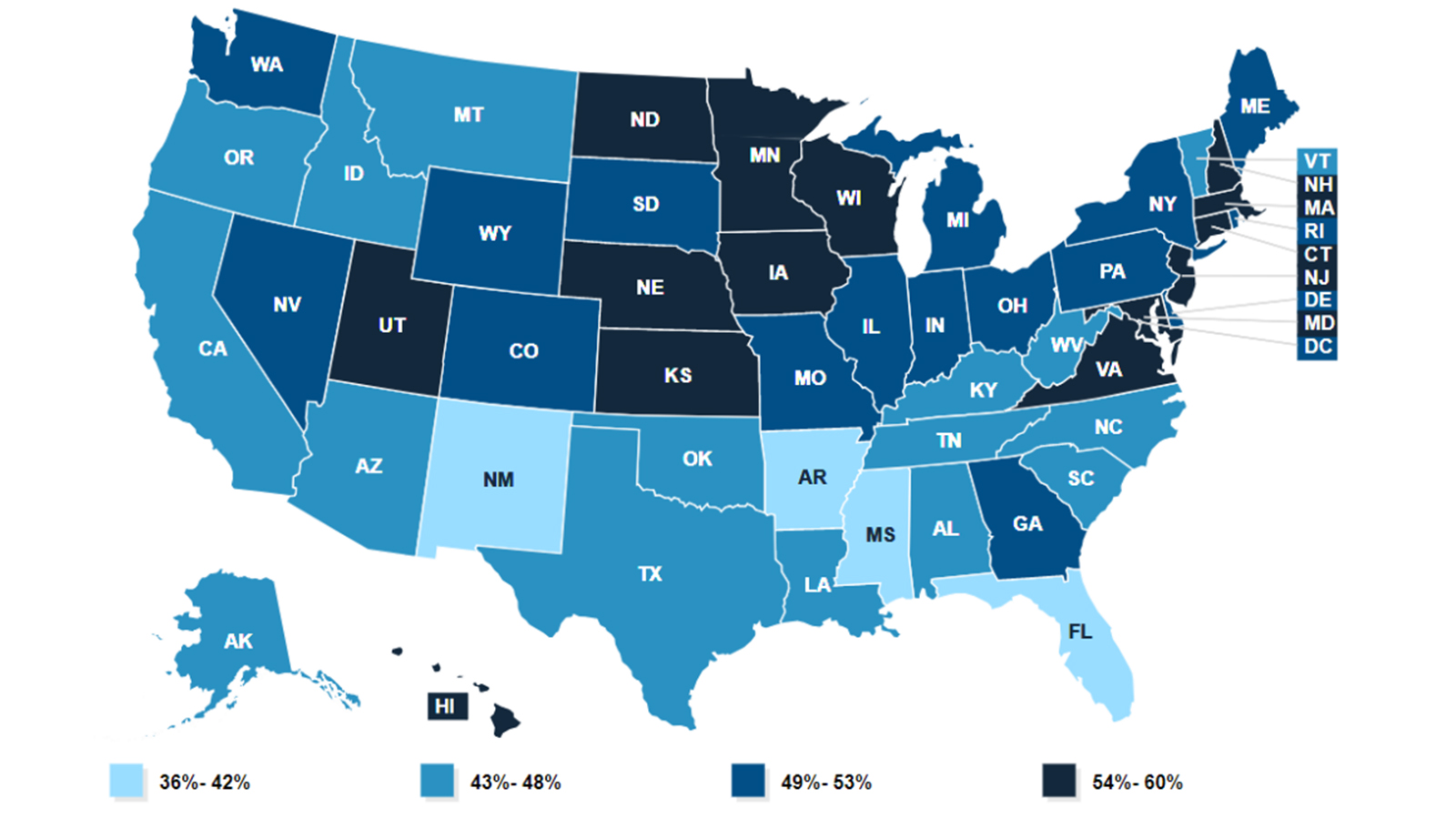

Researchers estimated how a 20% unemployment rate or higher – predicted by experts to hit in the coming months – could result in 25-43 million Americans losing their employer-based health insurance. As of 2019, roughly 49% of Americans received health insurance through their employer.

The study also coincides with a new coronavirus survey by plan provider HealthInsurance, revealing how 68% of Americans don’t know their options if they were to lose coverage, leaving many to question what are the best health insurance companies to turn to in the event of enrolling in a new plan.

The RWJF and Urban Institute study also predicts that up to seven million Americans will be unlikely to find new health insurance coverage as the economy continues its downturn, and will therefore lack access to healthcare during the worst pandemic we’ve seen in over a century.

Key findings in the RWJF study include:

- An estimated 25-43 million Americans could lose employer-sponsored health coverage.

- Over half of the newly unemployed will obtain Medicaid coverage in states that expanded Medicaid under the Affordable Care Act, but only around one-third will receive Medicaid coverage in the 15 states that have not expanded Medicaid.

- Less than a quarter of these workers and their dependents in expansion states will become uninsured, with roughly 40% in non-expansion states becoming uninsured.

Greater clarity needed for health coverage options

The new coronavirus survey by HealthInsurance shows that 1 in 4 Americans know someone who has already lost health insurance due to pandemic, and that 68% of respondents are unsure of their options if they were to lose coverage. The survey is one of several run by the health plan provider to gauge opinion on a range of topics relating to COVID-19, including the impact of the virus on health and the economy.

40% of respondents felt that the government should be responsible for ensuring people have health insurance coverage during a pandemic but, of course, the reality is very different. As the world still battles with COVID-19, the potential cost of associated health care costs has become a major source of anxiety for many Americans, especially for those who already entered the pandemic uninsured.

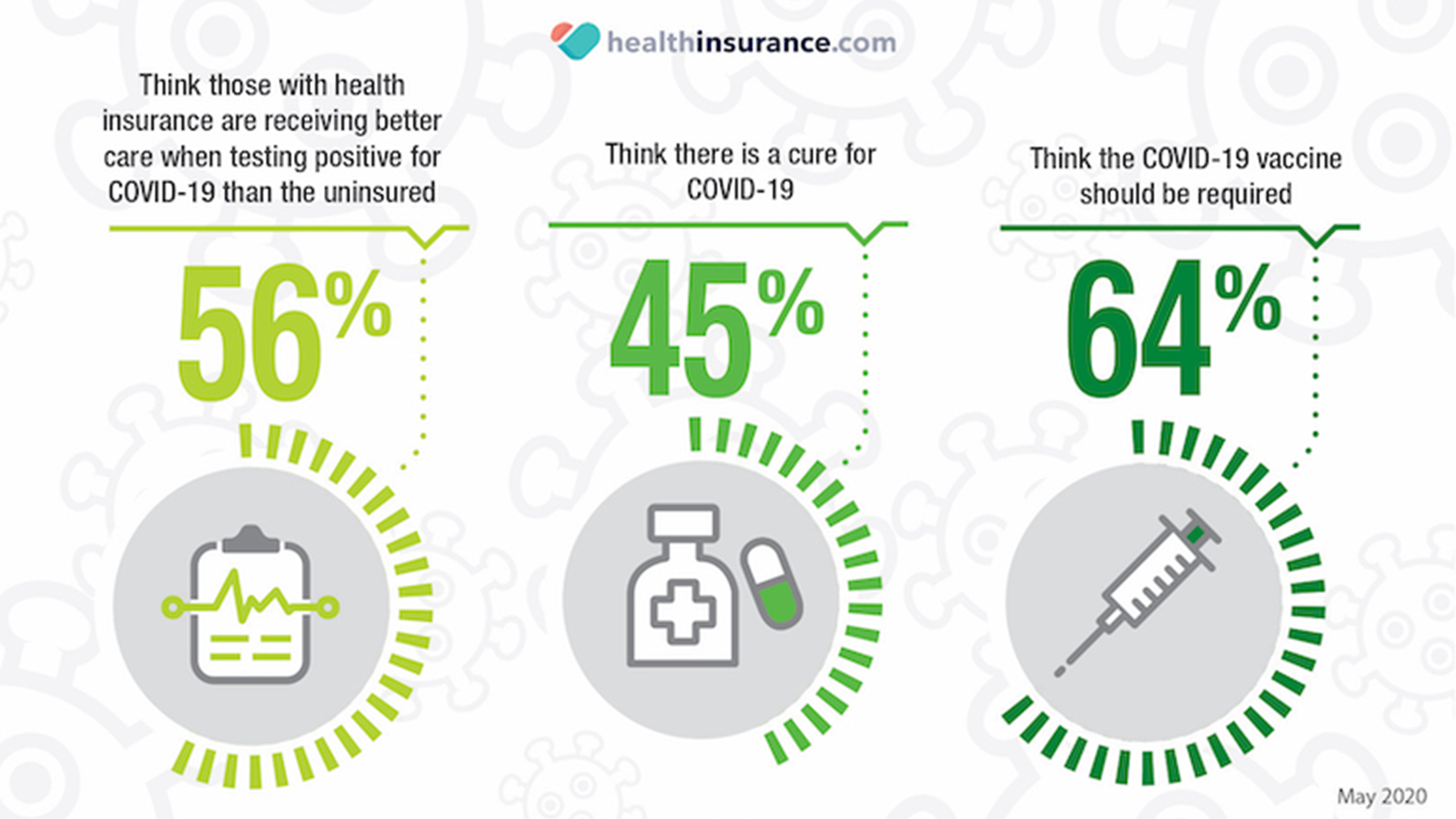

Other highlights of the survey include:

Last week, due to the ongoing pandemic, the Internal Revenue Service made it easier for employees to make mid-year changes to their health insurance coverage for 2020. Such changes mid-way through the year aren’t normally allowed, but under the new guidance employers can allow workers to drop out of their health insurance if they have another option, or to switch plans, or sign up for a plan if they opted not to earlier in the year. Workers are also allowed to add more family members to their existing plan.

Employers aren’t required by law to offer these new options, so they have to opt in to give employees the added flexibility with health insurance coverage. For many workers who previously decided not to take out health insurance, becoming insured now could give them added peace of mind should they need to return to the workplace before a COVID-19 vaccine is in place.

How to get health insurance if you lose your job: COBRA

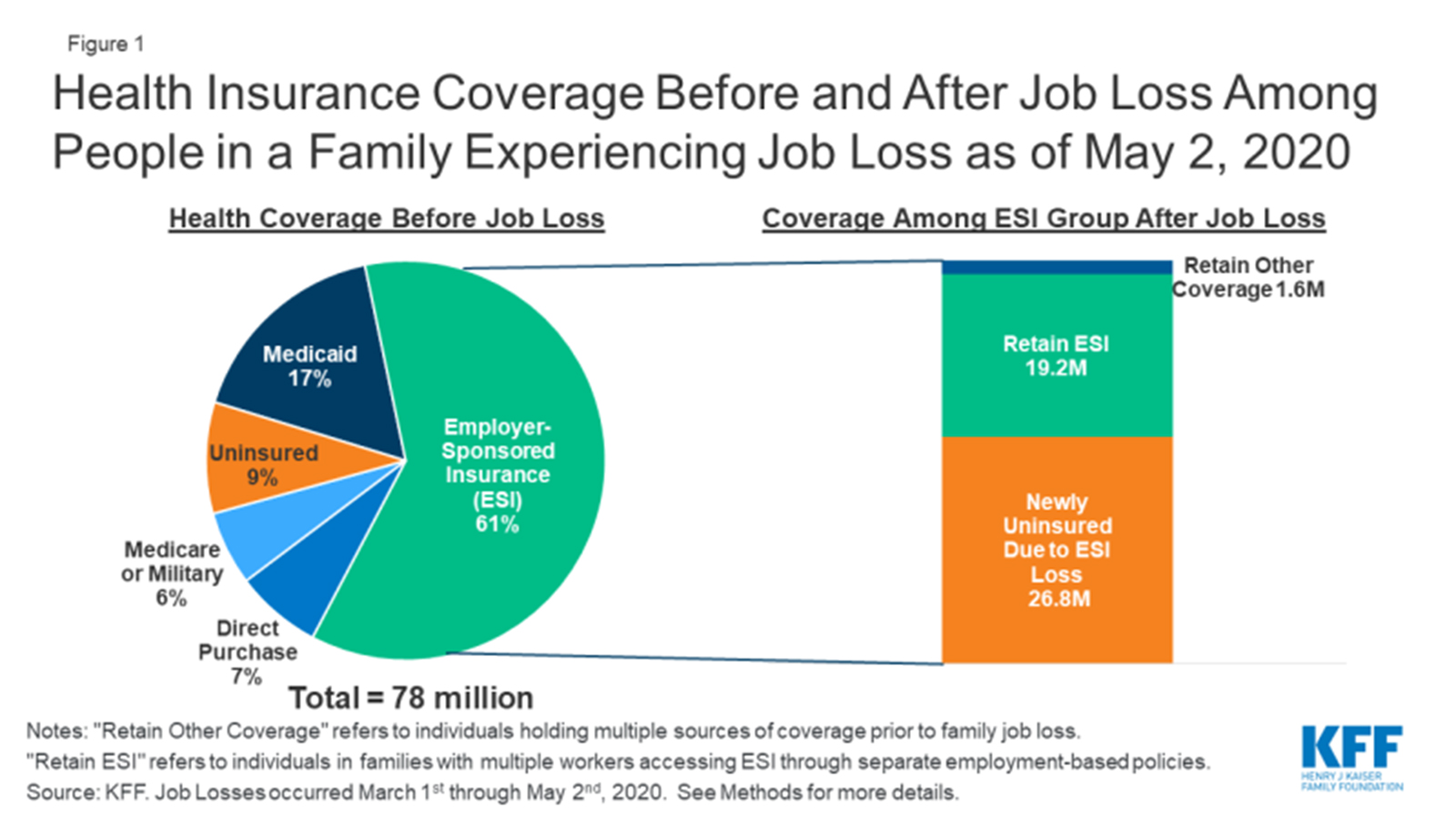

According to a report published by the Kaiser Family Foundation last week, over 31 million people filed for unemployment insurance between 1 March and 2 May. Actual job loss figures could be higher, due to the wide range of employment types and contracts, and the amount of people who have not yet filed for unemployment benefits.

The report advises that some Americans who lose employer-sponsored insurance (ESI) can elect to continue it by taking COBRA coverage, mainly to ensure a continuity of care. Under this provision of federal benefits law, workers who lose or leave a job can remain on the same insurance policy for up to 18 months. Some states offer a six-month continuation thereafter too. Paying the full premium can be very expensive, and a real shock to those of who have previously had coverage subsidized by an employer.

If you have recently quit or lost your job, your employer has to notify your health insurer within 30 days of you leaving or being let go. The insurance company will then send you information about how to keep your health insurance plan, and you usually have around 60 days to accept or decline.

Depending on the level of unemployment benefits received, plus the $600 a week federal pandemic benefit under the CARES Act, a COBRA continuation could be an option for some as a temporary stop-gap, but the high premiums that often arise with COBRA precludes many from taking this option. That’s because after your employment ends, you pay for the entirety of the plan, plus a 2% admin fee. Some companies are continuing to pay their portion of health premiums for furloughed staff, so check your status before looking into COBRA.

Medicaid and CHIP coverage

If you have lost your ESI, you may become eligible for Medicaid or subsidized health coverage via the Affordable Care Act (ACA). Medicaid is a program that provides health coverage for low-income families and children, pregnant women, the elderly and people with disabilities.

In some states, Medicaid is available for all adults who earn under a certain income threshold, but you’ll need to check with your specific state. To check your eligibility, select your state from the drop-down menu on the Medicaid website and apply. If you qualify, coverage begins immediately. If you need assistance with ongoing prescription drugs costs, take a look at our guide to the best Medicare Part D plans.

Even if you were told you didn’t qualify for Medicaid in the past, you may qualify now under the new rules. The current advice is to fill out an application in the Health Insurance Marketplace, where you’ll be told which programs you and your family qualify for, including Medicaid and/or CHIP.

Plans through Health Insurance Marketplace

If COBRA proves too expensive, head to HealthCare.Gov to check your state’s Health Insurance Marketplace options. You can pick health plans in accordance with ACA, also known as Obamacare. Typically, this is only available during open enrollment in the fall, but if you were getting health coverage at work and are now without it because of job loss, that results in a Special Enrollment Period where you can get on a plan now or change your existing plan for the rest of the year.

The national average premium for a silver level, or benchmark, marketplace plan in 2020 is $462, according to the Kaiser Family Foundation when analyzing average benchmark premiums. However, that figure doesn’t include Obamacare subsidies, which approximately 87% of Americans are eligible to receive. Head to HeathCare.gov to see how much you could save on health insurance, or use an Obamacare subsidy calculator. Marketplace plans go into effect the first day of the month after your job ends.

Looking for more insurance content? Also take a look at our guide to the best vision insurance companies, and the best dental insurance plans for individuals and families