United Healthcare is the parent company that bought Golden Rule in 2003 and now uses it as an underwriter. It's one of the few providers in our guide to the best dental insurance that offers as many as four different dental insurance plans, making it a good choice for those who need coverage variety and access to a wide pool of dentists.

The company has over 65 years of experience and an A+ rating from Standard & Poor's, meaning you don't need to worry about ongoing coverage support from this Fortune 500 company. But does that mean it's right for you? Let's take a look at what is on offer...

United Healthcare Golden Rule Dental Insurance review: Overview

Go to the official website and you'll be able to browse the United Healthcare Golden Rule plan options to find the best for you where it's possible to check pricing there and then. You can also apply for your chosen plan online, making the process very straightforward.

Expect most preventative care to be covered for free, with lots more beyond that covered too. The only thing you may find lacking is endodontics, so if that's what you need coverage for, this might not be the right dental insurer for you. We'd recommend taking a look at our explainer to what dental insurance covers. For everything else read on as you can find out everything you need to know about United Healthcare Golden Rule dental insurance.

- In-network savings up to 85 percent

- Over 85,000 dental offices

United Healthcare Golden Rule dental insurance uses a decent website to give you quotes quickly and easily on the plan for you. This, it claims, can take as little as 30 seconds and that seems close to fair. Input a few details like location, name and age and you can get started finding the best plan for you, with clear pricing given to you upfront so you know what to budget for.

There are both in-network and non-network options with the former having the broader range of plans. Age is another factor with plans tailored to suit the needs of the individual. Older people, for example, enjoy specific cover for things like dentures while children can have cover for orthodontia.

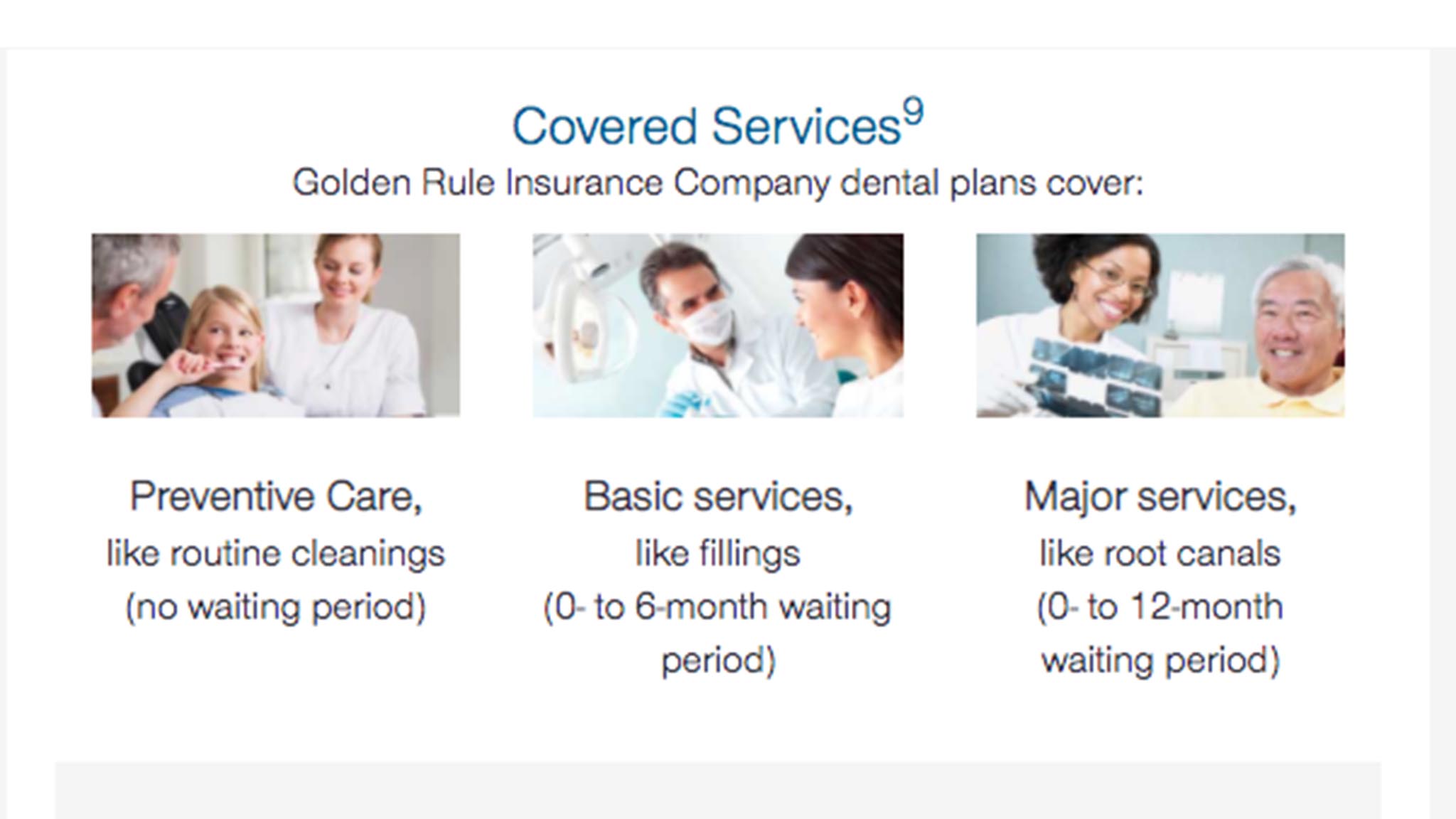

United Healthcare Golden Rule Dental Insurance review: What's covered?

- Orthodontics covered

- Exams, x-rays and cleanings

Cover varies between plans but at a basic level you can expect to get most preventative care for free, especially when on the higher end plans. That means no waiting period and no deductible to worry about either.

To put that in perspective, all plans net you two annual dental exams and routine cleanings. You also get a bitewing x-ray once a year and a full mouth x-ray every 36 months. For older customers, expect a complete set of dentures every 60 months and one crown or bridge per tooth every 60 months.

In order to look after your teeth as much as possible between trips to the dentist, make sure you're cleaning your twice properly for two minutes twice a day with one of the best electric toothbrushes. If you're dealing with staining, take a look at our guide to the best teeth whiteners for home use.

United Healthcare Golden Rule Dental Insurance review: Cost and plans

- Prices start at around $21 and go to about $192

- Four payment plans available

Coverage options: PPO

Plans available: Four

Snapshot: In-network savings up to 85 percent

If you're wondering how much does dental insurance cost, this varies wildly by provider. With United Healthcare Golden Rule the cost of care varies tremendously as the plans have so many options. That means you might be eligible for as little as around $21 per month payment or you may want to go all the way up to $192.

Realistically, for most people, pricing is going to range from $35 to $55 per month. At the minimum the annual max benefit tops out at $1,000 while at the top end that reaches $2,000. Alternative providers to check out include Delta Dental and Guardian Direct.

The plans quite clearly show the variations between each one making it relatively simple to pick the best one to suit your needs. The four options break down like this:

- Dental Saver: Only pay a copay for in-network, non-network it's as billed.

- Dental Plus: In-network copay after deductible, non-network it's as billed.

- Dental Basic: Preventative services are 100 percent covered.

- Dental Deluxe: Payments of up to $2,000 per person per year.

United Healthcare Golden Rule Dental Insurance review: User reviews

- ConsumerAffairs rating of just under three stars

- BBB rating of A+ for parent company

The Better Business Bureau (BBB) gives the parent company of United Healthcare a rating of A+. Look at the feedback and there is only one dental specific complaint and that's not even about the insurance plan itself.

ConsumerAffairs aggregates user reviews and has an overall rating of just under three stars out of five for the company. Positives include great knowledge and care given by staff and appreciated free cleanings and decent copays. Negatives seems to focus on not being sent as much money as expected to cover charges.

Should you choose United Healthcare Golden Rule Dental Insurance?

United Healthcare Golden Rule Insurance offers possibly the broadest range of plan options out there. The website lays these all out with clear pricing, what's covered and an ability to get signed up very quickly.

All plans cover basics for preventative care making it a potentially affordable option. For older customers or families there are great options for dentures and orthodontics. For those looking to go outside the network of dentists this is an option too with plans tailored to that - ideal for those that move around a lot.

Customers appear to appreciate the services of the company but there were a few complaints about incorrect payouts. Everything appears to be clear on the website so be sure you know what you need before signing up.

If you want further alternatives, take a look at our MetLife review for family coverage, or Humana for six different plans.