SurePayroll has been a company since 1999, and was acquired by PayChex in 2011. The brand name stayed and the payroll solution is still marketed as SurePayroll. SurePayroll has long had an online payroll solution, but up until now it had been a fairly expensive option and was missing some key features that many of it competitors offered.

This year, though, a revamped SurePayroll website promises a new, improved, cloud-deployed payroll solution and not only that but it is delivering this new product at a lower price. The SurePayroll plan has something for most sizes of business and even though it’s a one-size-fits-all solution, both small businesses, growing and medium businesses and even larger businesses will find features that will appeal to their payroll needs. One of the stand-out parts of SurePayroll is that it has some features specially designed for specific industries, more on that later.

The cloud deployment brings the usual litany of advantages, including the lack of a requirement to install expensive and inconvenient software and the channels of access that having a web-based application offer, both in terms of location and the times it is available. Like every cloud-deployed solution, it is available 24 hours a day to anyone with a log in and a device with a web browser and an internet connection.

There is also the bonus of free mobile applications for both administrators and employees, which edges them in front of those services that offer mobile-optimized versions of their website instead. The heralding of these new additions, though, should not distract from the areas that have still not yet been well attended to. The aesthetic design of the dashboard and so forth could have used a little more of a critical eye, and there’s a hint of slowness with the loading times occasionally. SurePayroll also charges extra for processing W2 and 1099 forms, something that many of their peers do for free. However, it’s a resurgent product and one that does have a lot to offer.

- Best Payroll Software

- Best Expense Management Software

- Best Personal Finance Software

- Best Accounting Software

Features

- A one-size fits all cloud-based payroll solution

- Offers unlimited payroll runs, and same day payroll

- Highly customizable and seamlessly integrates with a host of accounting software

Payroll processing: The payroll processing is cloud-hosted, and unlimited payroll runs are available, with same day payroll possible (for a fee)

Payroll reports: Dozens of report templates are available, and can be customized

Payment options: a choice of two ways to pay employees: direct deposits or checks

Payroll tax: Payroll tax obligations can be collated at every level, including completion essential forms such as W-2 and 1099, and though filing is not automated, it can be handled for a nominal fee

Operating Systems – iOS, Windows and Android

Hardware – not applicable as deployment is through the cloud

Free Trial – Offered to new customers, typically one month

Payment Options – SurePayroll has a base charge of $29.99 per month, plus $4 per employee per month

Support – Mon-Fri 7am-8pm and Sat 9am-1pm, Central Standard Time

It’s not the easiest problem to address: launching a one-size-fits-all payroll solution into an already-crowded market. The problem is attaining an attractive level of affordability and incorporating enough features and functionality to appeal to medium and larger businesses while keeping things pared down enough that small businesses won’t feel that they are wasting their money on surplus features that they don’t have any use for. With a relatively expensive product in the market from 2011, SurePayroll took a look at this problem and had another run at it. Given the compromises that all payroll solutions have to make, it didn’t do too bad a job this time out. The features have been bolstered and with a couple of exceptions, they seem to have hit that sweet spot of versatility. At the same time, and this is perhaps the most impressive part, they have lowered prices. A product that used to be among the more expensive payroll solutions on the market is now among the most affordable, or at least the best value. What that translates into is a package that has a base rate of $29.99 per month, plus $4 per employee per month (with some services costing extra, see below).

The essential perks are all featured. Administrators can run payroll unlimited times, and SurePayroll offers same day and next day payroll (a nominal fee and has to be processed by 10.30am or 3pm Central Standard Time respectively). Otherwise, it’s a two-day turnaround for no extra cost. Payment can be made as direct deposits or pay checks. SurePayroll has newly integrated a huge array of compliance and tax information to make calculations even smoother and it does offer automated W-2 and 1099 forms, but again, there is a nominal charge (pricing for these charges is not made public). That all-important, time-saving employee access is good, thanks to the cloud-based deployment and the free application that comes for mobile access. The number of reports has also been improved and some sections of the functionality are designed with specific industries in mind – dentists, restaurants, non-profits, etc – and there are some winning customization options.

Design and usability

- Cloud-hosted deployment means accessibility any time

- Comprehensive dashboard that integrates a range of HR and POS functionalities

- A more contemporary feel to design and navigation

The changes already noted in SurePayroll’s new, revamped package don’t just stretch to adding new features and functionalities. SurePayroll took a look at the design and navigation as well, and obviously spent time bringing a new, more contemporary feel to the overall look. As far as aesthetics go, payroll solution interfaces tend to err on the functional side, and some can look particularly utilitarian and bland. Some solutions, for instance Square Payroll go completely the opposite way and their front end appears almost like a social media site with primary colors and outsized buttons. SurePayroll lands somewhere in the middle. Unusually, it eschews primary colors and has greens, yellows and oranges embellishing the dashboard, which makes it stand out among its competitors.

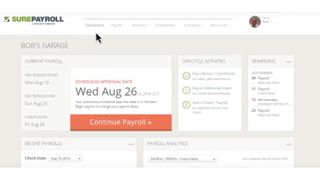

The dashboard is modular and has five sections as you log in, including Current Payroll (with information concerning the next scheduled payroll date), Off-Cycle Activities, Reminders, Recent Payroll and Payroll Analytics. The next scheduled payroll date is brightly highlighted in orange and is hard to miss. Meanwhile, the payroll analytics are displayed in graph, with Payroll Expenses clearly marked. The dashboard does look clean and well-designed, though there’s something faintly retro (whether by design or by accident) about the color scheme that means it falls short of looking cutting edge or completely contemporary.

The design of the layout is also perhaps a little crowded but then some administrators will favor a lot of essential information right there on the dashboard so that they don’t have to click in and around the site to find it. There’s a toolbar up at the top of the screen with tabs clicking through to Payroll, Reports, Employees, Company and Resources. This latter category is general but includes such functions as reminder preferences, employee enrollment documents and end of year tax information. Clicking on these tabs will bring up a drop-down menu with everything that tab contains.

Navigation is easy enough and there’s no endlessly opening different work screens and having to close them down. Working within each of the sections is pleasingly straight-forward too, with a mix of blank fields, multiple choice buttons, links and prompts to help administrators through the onerous tasks of set up and the like. The only relatively complex section is the Employee tab, which has a lot more detail than other screens. Helpful toolbars pop up, though, to guide you through the process, and will mark themselves ‘done’ when the information looks to be complete. Overall, it’s an intuitive and smooth navigation process.

Performance

- Unlimited payroll runs and payroll processing takes just minutes

- Dozens of inbuilt report templates help with post-payroll analysis

- Designed for full integration with QuickBooks

As with all cloud-deployed payroll solutions, the setup process is the most labor-intensive and detailed. With this in mind, SurePayroll has introduced a new setup process, and while it’s as straightforward as it can be, there’s really no way to get around the data entry that’s necessary at this stage. The improved employee portals certainly help a lot, and some basic data input can be farmed out to individual employees, which is a time-saver for the administrators. Telephone support is available for this process. The setup process is slightly truncated for SurePayroll – although it collects personal and tax information, there’s a slight shortcoming in that deductions, earnings types and some other garnishments aren’t yet included in the software.

Running the payroll itself is where SurePayroll really comes into its own. It has special functionality features relative to which industry the user works in, including restaurants, non-profits, dentists, agriculture and healthcare. It also has notably good integration levels with accounting and financial software such as QuickBooks and Xero. When payroll information has been entered and payroll is ready to run, SurePayroll handily shows all a preview screen with employees divided by salaried, hourly, contractors, etc. Here, you can add ‘Other Compensation’ figures, including bonuses, tips, etc. If our payroll is an unchanging one with the same salaried employees, we can of course set it to run automatically.

One very useful tool that SurePayroll offers that not all of its competitors do is the option to save the payroll and come back to it at a later date. We also have options to start over or reset. As we progress through the payroll process, reminders flag up checks that need to be printed. There’s also a good failsafe check before payroll is approved, with administrators having to check a box that makes sure that they understand the amount of money that shows will be taken from the company account, and so it’s as foolproof as it can be. The standard waiting period is two days, though users can pay a fee (unpublished) for same or next day processing. There’s a generous range of customizable reports that are immediately available to run and be exported in a number of file formats. Again, although tax information is compiled, SurePayroll charge a nominal fee (again, unpublished) for submitting W-2 and 1099 forms.

Verdict

After its previous incarnation as a relatively expensive payroll solution, SurePayroll has taken a look at its product and come back with a solution that’s much more attractive and affordable. The new design is an improvement and processes have been streamlined alongside the cost dropping. Small businesses will like the budget-friendly price and larger companies will be impressed by the functionality. SurePayroll’s flexibility and industry-specific touches are also a bonus, as are the mobile applications. The extra charges for tax processing that other companies offer for free and the slightly curtailed setup process are certainly things to consider, but all in all, it’s a robust, flexible solution for a good price and one of the better one-size-fits-all solutions on the market.