Best electric head shavers: Including the top bald head shavers

Buying guide The best electric head shavers make shaving your head at home a genuine pleasure.

Find reviews and recommendations for the latest health & wellness products.

Buying guide The best electric head shavers make shaving your head at home a genuine pleasure.

BUYING GUIDE Rest in one of the best ergonomic office chairs for the ultimate back support.

Buying guide Breeze through your next trip with the best hard shell luggage, including durable and lightweight suitcases from the likes of Samsonite and American Tourister.

Buying guide The best carry-on luggage should make traveling a breeze with top features like spinner wheels, TSA-approved locks, laptop sleeves and durable hard shells.

Buying guide We've compiled a list of the ten best travel backpacks for every type of trip and traveler, from adventure-seekers to city sightseers.

Buying guide These are the very best luggage models to protect your belongings, help you pack more efficiently and get you from A to B without any extra hassle.

Buying guide Enhance your traveling experience with one of the best travel pillows.

The Fitbit Sense 2 works intuitively and has a great battery life, making it a worthwhile investment for those interested in learning more about their health

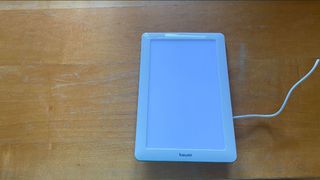

Review We tried out the Beurer TL41 Touch Daylight Therapy Lamp to see if this medical-grade compact product can help improve symptoms of Seasonal Affective Disorder.

Review The Beurer TL30 daylight therapy lamp is designed to alleviate SAD symptoms and improve your mood during the winter. We put this claim to the test.

Review A great alternative office chair option for those suffering from back issues, but the Varier Variable Plus does come at a hefty price.

Review The Molekule Air Pro is an effective air purifier, but it prioritizes design over performance and lacks the connectivity of other purifiers.

Review Create a healthy work environment with the stylish and functional FlexiSpot E7 standing desk.