Editor's Note: This review has been removed from our side-by-side comparison because they no longer offer individual identity theft protection services. The original review is below, but Top Ten Reviews is no longer updating the information on this page. Check out our current top 10 Identity Theft Protection Services here.

AllClear ID monitors many types of records and personal information in order to keep you safe from identity theft. Additionally, it provides a $1 million insurance policy and service guarantee so even if something does happen to your personal information, you won't suffer financially. This identity theft protection service helps to restore your good name with its effective resolution services, even if you are not a subscribed member.

This fraud prevention service monitors your full name, social security number, credit card information, physical address and phone number. Unfortunately, it doesn't monitor public records, lease and loan information, driver’s license numbers or medical insurance numbers. Additionally, it does not monitor criminal records or sex offender lists. The primarily focus of this service is on financial information, the area most commonly targeted for identity fraud.

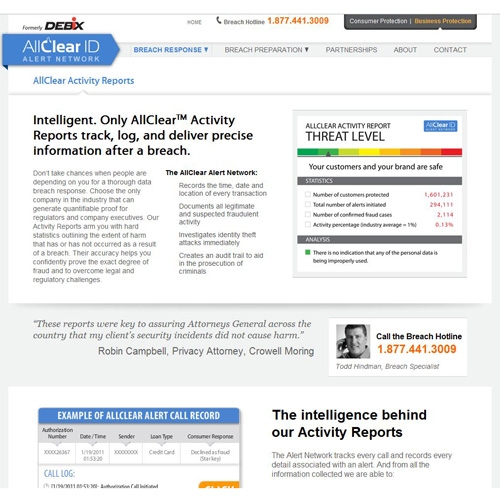

AllClear ID monitors the information the three major credit bureaus collect. If this identity theft protection service discovers a potentially fraudulent request, it will contact you immediately using an automated system. The service calls you using secure technology to verify your identity and confirms that you authorized the request for credit. If you didn't, it will connect you to an on-call investigator. The investigator will immediately begin looking into the matter and will work with you until the situation is fully resolved.

AllClear will spend up to $1 million to investigate and resolve issues concerning your identity theft as well as cover certain fees, such as lost wages and fraud losses related to recovering your identity.

You can contact the AllClear investigators with questions at any time. They can guide you through additional protections such as ordering your free annual credit report, signing up for junk mail reduction and ordering other free reports like your employment history.

AllClear offers two beneficial features not found with all ID theft protection companies. You can add minors for a small fee, which is an important option because children are 30 to 50 percent more susceptible to identity theft than adults. In addition, if you have been a victim of identity fraud and are looking for help restoring your good name, AllClear offers resolution services for a one-time fee.

AllClear ID provides good identity theft protection service. Not only will it protect your information and help restore your identity if it is stolen, but AllClear can also accommodate family members and offers services for victims of identity fraud. While it doesn't offer all the features of the higher-rated plans on our lineup, it is still a respectable service.