Top Ten Reviews Verdict

USAA has a very good quote process and the highest customer satisfaction rating in the country. If you have any military connections, it's worth looking into.

Pros

- +

It has the highest customer satisfaction rating

Cons

- -

Only military personnel and their families are eligible

Why you can trust Top Ten Reviews

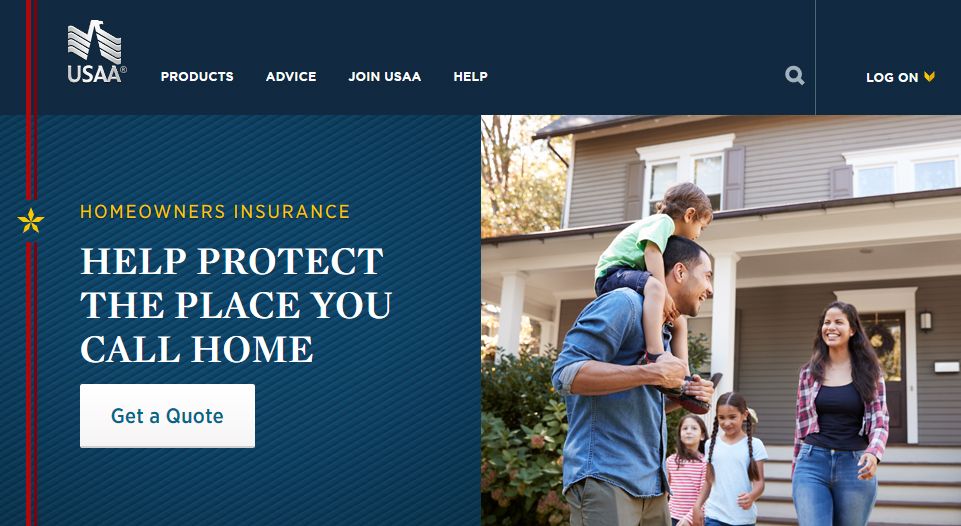

Despite its relatively strict membership requirements – only current and past military members and their families are eligible – USAA is among the biggest providers of homeowners insurance in the country, with a total asset value of $155.39 billion. In addition, it has the highest customer satisfaction score of the 31 insurance companies J.D. Power studied. USAA's members are among the most devoted policy holders, which likely has a lot to do with its profit sharing – since the company has no shareholders, profits are either retained to bolster financial strength or divvied up to members. This means you can get a significant portion of your premium back if USAA has a good year. For example, in 2015, USAA returned $1.666 billion to its members.

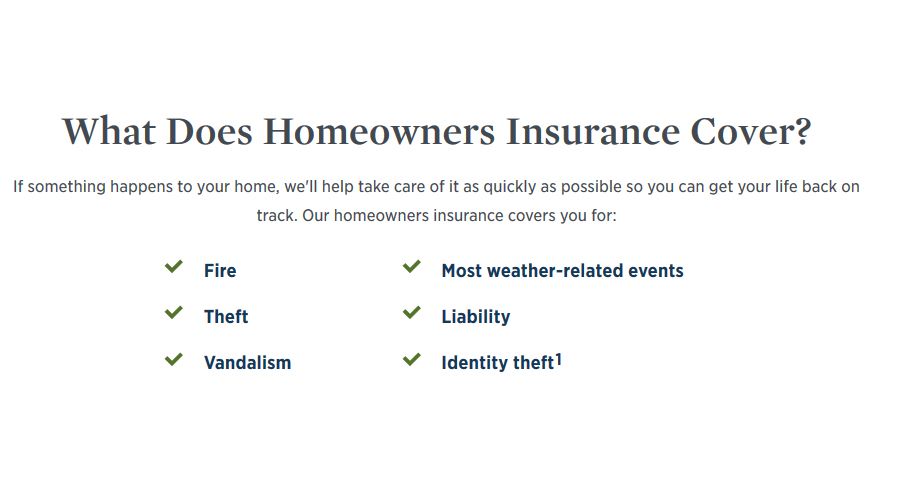

Quoting Process

Since I’m not a homeowner, I got quotes for my parents’ home for this review. Because I already knew the actual reconstruction value of the home, I also compared the accuracy of the quotes I was provided. This was the most important part of the quotes not only because it represents what the company pays out if your home is destroyed but also because it’s what varied most from quote to quote during testing. All the other coverages and liability limits were nearly identical from one provider to the next.

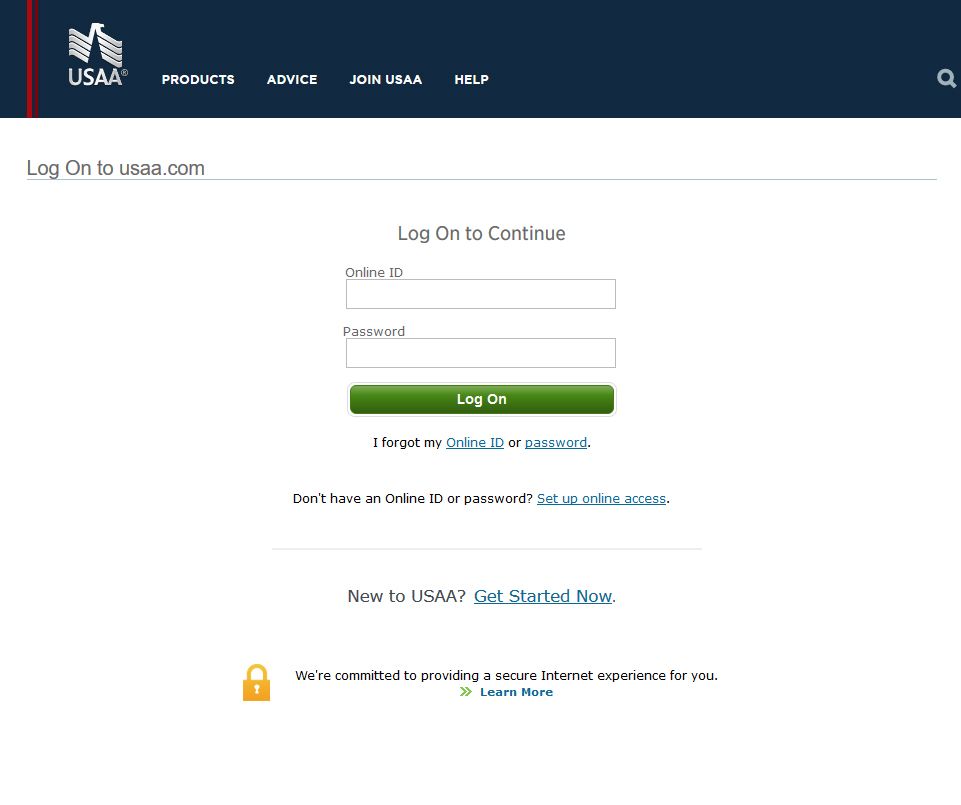

USAA's quote process requires USAA member login credentials. This is the biggest downside, as you can't get a quote unless you are a member. Fortunately, one of my co-workers has a membership, and we were able to walk through the quote process. In total, it asked 41 questions. This was fewer than average, as most quote tools asked about 51 questions. For comparison, State Farm, my top pick, asked 123 questions and provided the most accurate reconstruction value quote. USAA's reconstruction value quote was about $150,000 below the actual value, but it was a lot closer than many providers. In addition, you can adjust the value with more accurate data. Of course, that affects the premium, for better or worse.

J.D. Power Customer Satisfaction Study

In the 2017 J.D. Power study of homeowners insurance providers, 15,909 customers with policies from 31 companies were interviewed. USAA received the highest customer satisfaction score: 892. For comparison, the second highest score, given to Amica Mutual, was 866. These are the only two insurance providers to receive a five power circles in each of the five categories in the study – pricing, claims, interaction, policy offerings and billing.

Ultimately, however, USAA didn’t receive the award for best customer satisfaction because its policies are only available to USAA members, so you must have served in the military or have family members who have served to qualify. If you meet these requirements, USAA is likely your best option.

Sign up to receive the latest news, reviews, buying guides and deals direct to your inbox

Agents

Reviews

United Healthcare Golden Rule Dental Insurance review

Humana Dental Insurance review

Guardian Direct Dental Insurance review

Security National Life Final Expense Insurance Review

State Farm Final Expense Insurance Review

Northwestern Mutual Life Insurance review

New York Life Insurance review

Similar to Amica Mutual, USAA doesn't have an agent finder tool, so you can’t contact a local agent to help you navigate the nuances of homeowners insurance. Of course, its online support is excellent. The company's mobile app has won awards for support, and its website is loaded with articles, calculators and articles. Still, it’s difficult to replace the experience of consulting with a local insurance agent, as they are more intimately aware of the insurance considerations specific to your area than a support person on a phone call.

If you have any connection to the military, USAA is your best option for homeowners insurance. Not only does it have the highest customer satisfaction scores, but it's also a very financially strong company and returns profits to its members. As such, you could pay much less for your insurance in the long run.

Jeph is a freelance writer who specializes in automotive subjects, like car stereos, and tech. With a Masters degree in Fiction from San Diego State University, he has written extensively for Top Ten Reviews on subjects ranging from car speakers and Bluetooth devices, all the way through to online file storage and backup software.