Chase Mortgage is one of the big players in the mortgage and refinance lender industry so, as you might expect, there are a wide range of mortgage, refinance and home equity products available via its website. Visitors will also find mortgage calculators and other tools to work out affordability and mortgage rates. Mortgages come in fixed and adjustable rate options with the former on 10, 15, 20, 25 and 30-year terms. Adjustable rate mortgages are available on 5,7 and 10-year terms and Chase Mortgage’s jumbo loans are available up to $3 million.

Chase Mortgage: DreaMaker Program

In addition to FHA and VA loans, Chase has its own DreaMaker program for homebuyers with less cash or lower credit scores. Through this program, borrowers can put as little as 3% down (with a credit score of 680 or above; 5% if it’s 620 to 689). Depending on eligibility there’s a $2,500 grant available to use toward closing costs, discount points or a down payment and another $500 for completing a homebuyer education course. The bank’s private mortgage insurance costs are also lower through this program.

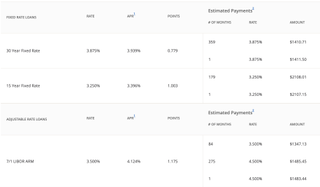

Chase Mortgage: Rates and Fees

Chase’s mortgage rates appear to be slightly higher than those of other large lenders, such as Wells Fargo mortgages, but the difference between its interest rates and annual percentage rate was minimal, indicating lower fees. An online calculator shows you the possible fees charged on various loans.

Chase HELOC and Home Equity loans

Chase doesn't offer home equity loans, but does offer HELOCs with a good loan-to-value ratio, which you can find online. This is the amount you still owe on your mortgage divided by the current value of the property. You can find a LTV calculator and a home value estimator on the website to help you determine how much you qualify for. In addition, the online application asks for this information to make sure you qualify before you go through the process of inputting information. Chase’s HELOCs come with the option to lock the interest rate on part or all the outstanding balance while the draw period is offered for a fee.

Chase Mortgages: Customer Experience

There are Chase branches in 22 states and the website offers online application. Once submitted borrowers need to create an online account in My Chase Mortgage which will allow submission of documents and general tracking of the process. Chase ranks slightly above average in customer satisfaction on J.D. Power’s 2018 survey and, as is the case with other lenders, the experience will depend in a large part on the individual handling the loan.

Chase Mortgage and Home Equity: Verdict

Chase Mortgage offers an impressive range of mortgage products backed up by some extensive educational information and online tools. There’s an equally good range of HELOCs available also for renovations and improvement. Look out for charges on rate locks and expect to speak to a loan officer to get the full picture on rates and requirements unless you open an online account.

Editorial disclaimer: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.