Established in 1874, Foresters Financial undoubtedly has the wealth of knowledge and experience required of the best final expense insurance providers. Foresters serves the needs of more than three million customers and members in the United States, Canada and the United Kingdom, and prides itself on its fraternal benefit society status.

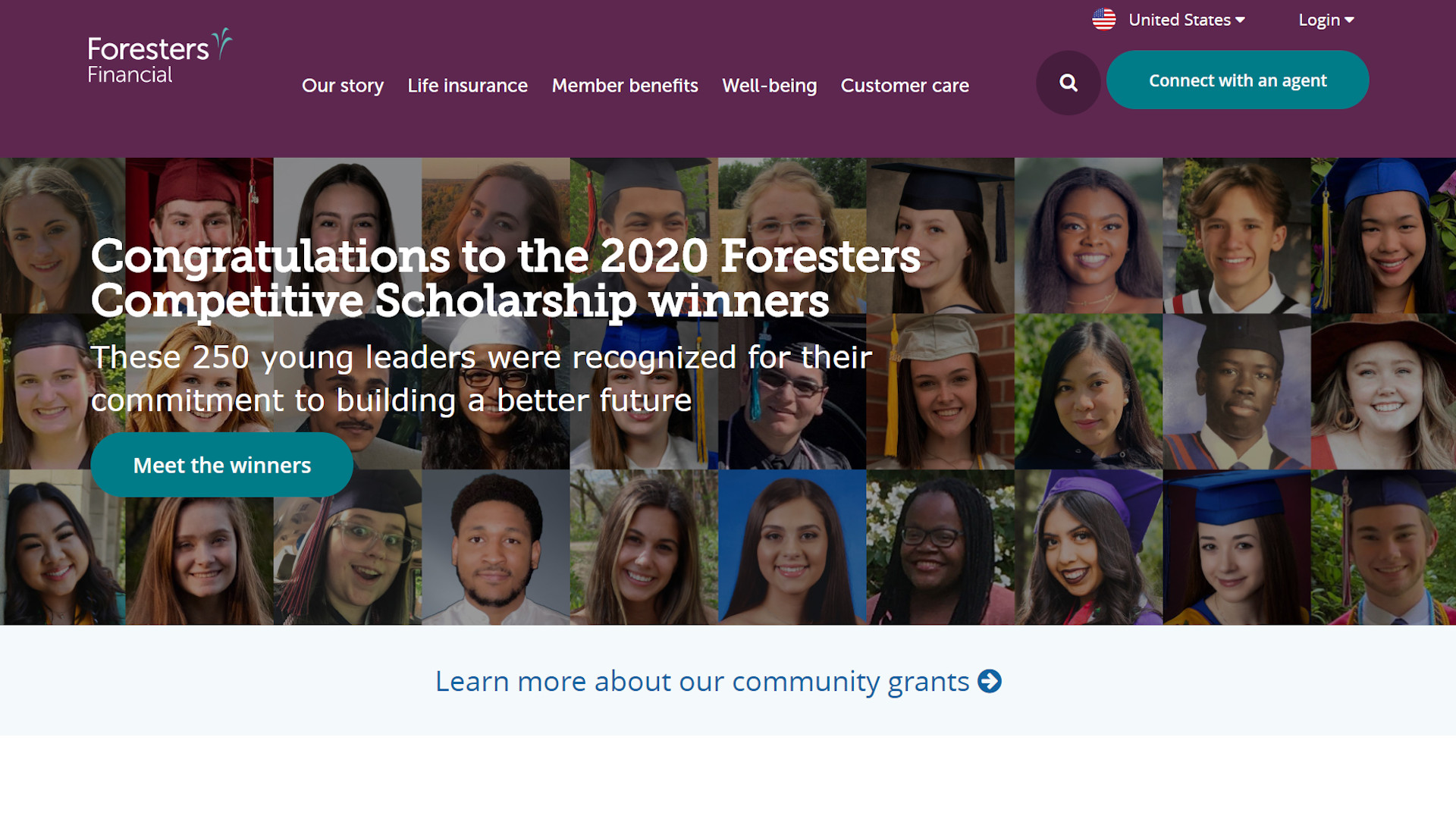

This means its members can access benefits not offered by traditional insurance policies – things like eligibility for grants and scholarships, and free and discounted legal services, that can be used to prepare a will, or for home ownership and family law. Community participation is a priority for Foresters too, with members allowed access to funds to organize and host their own local community volunteer activities and fun family events. Besides final expense insurance, Foresters provides standard term life insurance policies too.

Foresters review: What is on offer

Foresters' final expense insurance cover - PlanRight - is a whole life insurance plan designed specifically to ease the financial burden of final expenses. Premiums are level and fixed as long as you keep the coverage. The plan comes in three tiers – two that can immediately pay a full death benefit (Preferred and Standard) and one that can provide a limited benefit (Basic) in the first two years, and a full death benefit thereafter.

There are also various riders available at no extra expense for certain tiers, including an accelerated death benefit rider, which pays out a portion of the benefit early on diagnosis of terminal illness, and a common carrier accidental death rider, which pays extra if death results from an accident that occurs as a fare-paying passenger on a plane, bus, or train. If you're willing to pay more on top of your premium, and you qualify for the preferred plan, an optional accidental death rider is also available that will pay extra in the event of accidental death.

Foresters review: Application process

The PlanRight tier you are eligible for will depend on your health profile. This will be determined during the application process, which consists of a point of sale interview with an agent during which you will be questioned about your health and medical history. However, no medical examination or blood tests are required.

To get the process under way, you will need to connect with an agent - there is a toll-free number on the website or you can fill out an online form, and state whether you would like to be contacted by email or phone. From here, Foresters will put you in touch with independent life insurance representatives from your area, from whom you can choose to take your application forward.

Foresters review: The finer details

Across all tiers, applicants must be at least 50 years old and the minimum cover that can be taken out is $5,000. The minimum monthly premium that must be paid is set at $10, while there is an upper limit on cover of age 121, should you be anticipating living that long.

The remaining details will depend on the tier into which you fall. If Foresters consider you low risk health wise - meaning you will likely have said no to all the health questions - you are likely to be eligible for the Preferred plan. This offers full protection immediately, and is available to those between the ages of 50 and 85. The maximum benefit available is $35,000 up to the age of 80, and $15,000 thereafter.

If you have certain conditions that Foresters' underwriters are a little wary of, you will be offered Standard cover, which is also payable immediately, but has lower maximum coverage of $20,000 to age 80 and $10,000 if you're between 81 and 85.

The final tier - the Basic plan - is the option that could be offered to those with more serious medical concerns. It is limited to a maximum age of 80 and cover can be for no more than $15,000. Also with the Basic plan, full coverage will only be paid two years after the plan commences - if a claim needs to be made within the first two years, the payout will amount to the premiums you have paid plus 10% annual interest.

Foresters review: Service

Foresters' website is attractive and easy to navigate. A lot of space is devoted to how Foresters works, its history and its wider aims as a fraternal benefit society in relation to members and communities. There is also a considerable amount of detail regarding the additional benefits on offer to members, but what is maybe lacking is real insight into the finer details of its product offerings. While there is a perfectly adequate and easy to understand explanation of each product option, if you're looking for age limits, maximum benefit amounts, or health requirements, then they are not readily found.

Obviously such things will be explained along the line, and apart from this minor gripe, there is much to admire, including a useful life insurance needs calculator and helpful resources relating to maintaining a healthy body and mind.

In terms of customer care, you can contact Foresters over the phone, via email or by mail. Once you have agreed on your agent, they could be another point of contact too, while customers can also log in online to access their account. Foresters receives an A- rating from the Better Business Bureau and has been rated A for the strength of its balance sheet and operating performance for 19 years running by A.M. Best.

Should you use Foresters final expense insurance?

Foresters is among the most reliable of final expense insurance companies and one of the best. The plan options are wide-ranging, with coverage and age intervals that should suit most applicants, while you know that you're dealing with a hugely knowledgeable and trusted provider too.

Granted, some greater upfront detail on the plan parameters might be welcome, but all the other support resources are well-crafted and plentiful. What Foresters can also offer are all the additional benefits available to members - if you want something a little extra in your final expense insurance provider, you needn't look much further.