Discover Student Loans: What you need to know

Discover is a competitive option for a student loan provider, but for all of the provider's merits, opting for a Discover student loan certainly has its drawbacks. Discover student loans are great for a particular student profile, but generally do not fit the needs of most students, particularly in the areas of loan interest and co-signing.

Loan type: Undergraduate, Graduate, MBA, Law, Consolidation, Healthcare degrees; Bar exam; Residency

Rate type: Fixed or variable

Loan term: 10, 15 or 20 years (fixed and dependent on the type of degree being earned)

Loan amount: $1,000 minimum. Up to 100% of school-certified college and graduate school costs

Application and origination fees: No application, origination, disbursement or prepayment fees

Discounts: 0.25% interest rate reduction for autopayments

Repayment options: In-school interest-only, in-school fixed (monthly payments of $25 during school and grace period), and deferred repayment option

Deferment or forbearance hardship options: Deferment, forbearance, and other hardship options available depending on eligibility

Co-signer release: None

Grace period: 6 months

Perks: Students with at least a 3.0 GPA (or equivalent) get a one-time cash reward per loan, amounting to 1% of the loan

Discover Student Loans: Common questions

Does Discover offer student loan refinancing?

Yes. Discover has a program for borrowers who want to consolidate or refinance both federal and private student loans. If your circumstances change and Discover's benefits suit your needs, you may be able to lower your interest rate, lower monthly payments, ad simplifying the payment process by making only one payment a month. Both variable and fixed rates over 10 and 20 year terms for loan refinancing are lower than Discover's student loans'.

How is Discover's customer service?

Discover's student loans customer service exceeds expectations and, unlike many private student loan providers, the bank offers 24/7 support through student loan specialists.

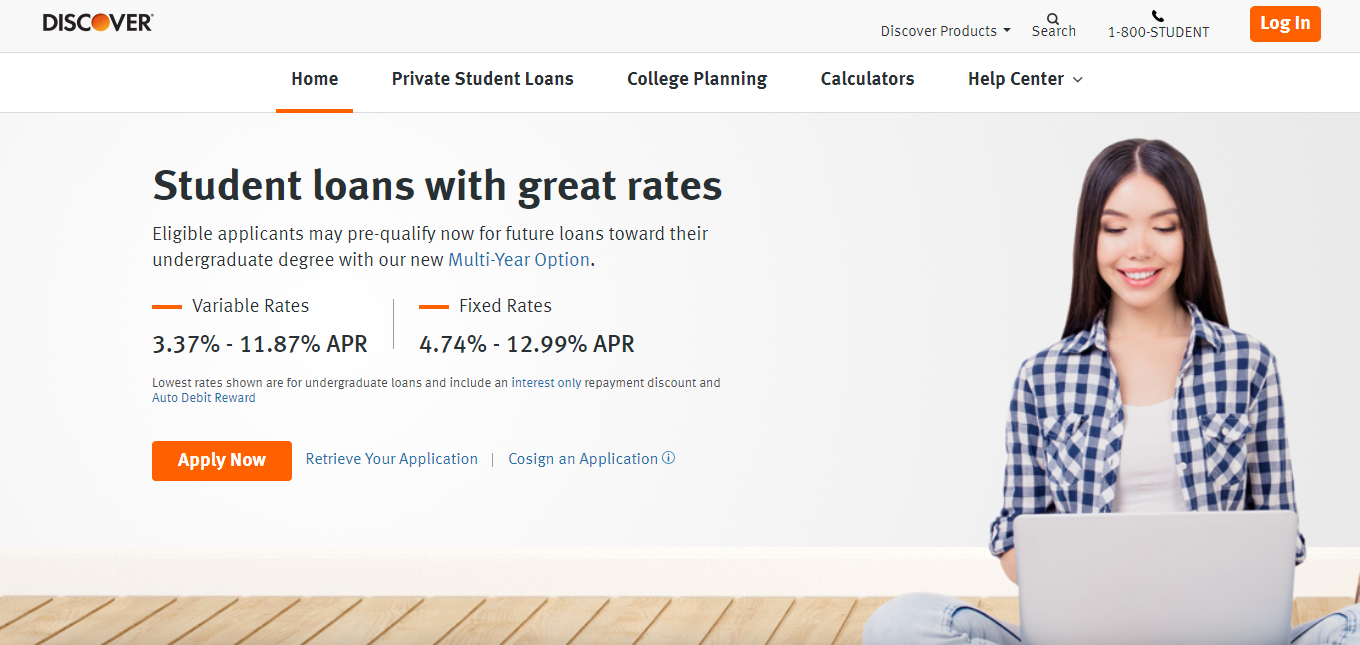

What is Discover's interest rates for student loans?

Discover has both fixed and variable interest rates for its student loans. While the variable rates are higher than most lenders', the bank's fixed interest rate remains competitive for all student loans regardless of degree earned. Variable rates range from 3.37% to 11.87% and fixed rates vary from 4.74% to 12.99%.

Do Discover student loan programs include scholarships?

Discover doesn't offer any of its own scholarships, but the Discover Bank website has a helpful link to a repository of scholarships which students can apply for online. From there, you may be redirected to the scholarship's platform where you will find instructions on how to apply. Discover's search feature also allows borrowers to filter scholarships by race, major, and special circumstances.

Discover student loans and co-signers

As it is with most private lenders, borrowers - especially young borrowers with little credit history - are more likely to get a better rate on their student loans with a co-signer with more established credit than if they apply for a loan without one.

However, while Discover tends to be relatively straightforward about its loan details, the institution is still somewhat hazy about its policy on co-signers. After some digging, we found that, generally speaking, co-signers cannot be released for the duration of the life of the loan. This is unhelpful for those whose co-signers may eventually want to be released after a few years. This issue is exacerbated by the fact that Discover's loans have long fixed terms: even if you are only borrowing the minimum amount, you would still need to pay off your loan over the course of the fixed, pre-determined loan life. For undergraduates, for example, this amounts to 15 years. However, there is a form that can be found on Discover's website that allows co-signers to be released under specific circumstances.

Discover Student Loans: Advantages

Discover student loans have many advantages over other student loan providers, making it a worthy choice for a specific type of student. One of the key advantages of exploring Discover as an option as a student loan lender is that its website is very thorough about the details of a loan.

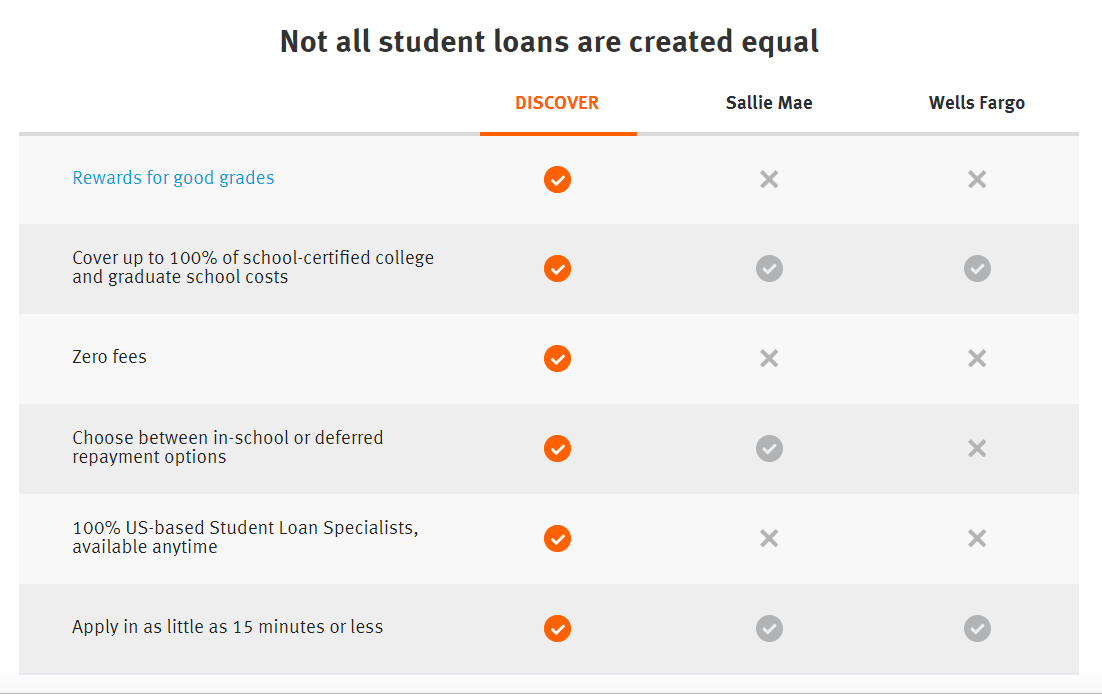

It has helpful comparison charts to help you decide which lender is right for you. Unlike many student loan providers, Discover is also relatively more transparent about its deferment options in the event of financial hardship, which may reassure many borrowers and their families, especially if they anticipate circumstances in which they would not be able to make the monthly payment. There is little to no fine print, meaning that the website or Discover's student loan experts can answer most, if not all of your questions.

The application

According to Discover, borrowers can complete the application for a Discover student loan in as little as 15 minutes. However, this is provided that you have every piece of information you need to complete the application. It is also unclear whether or not this includes the co-signer application, but generally speaking, a short and easy application is an easy selling point for many potential borrowers.

The loan

Although many private lenders offer this perk, every dollar counts: Discover does not charge any fees associated to the loan - including late fees. Although Discover is a little shy in divulging its entire late payment policy on its website, it does state that borrowers will not be charged fees, including a late payment fee.

Repayment

Discover student loan fixed rates are quite competitive and are on-par, if not lower than the average range of fixed interest rates of other private lenders. Discover's repayment options are also considered to be some of the more flexible options on the market.

While in school

A key benefit of opting for a Discover student loan is the Rewards for Good Grades policy. Applications for Discover undergraduate, health professions, law, MBA or graduate loans submitted after May 2014 are eligible. The policy stipulates that students working toward these degrees must maintain a 3.0 GPA or their school's equivalent in order to receive a one-time 1% cash reward of the loan amount. This means that, if your are an undergrad who takes out a student loan with Discover every year for 4 years, you can earn 1% of each loan if you maintain good grades.

Customer service

Unlike many student loan providers, many customers report positive experiences talking to Discover student loan experts through customer service. Customer service is reportedly available 24/7 so borrowers and their co-signers can get help anytime.

Discover Student Loans: Disadvantages

While Discover student loans don't have many disadvantages, the ones that we've pinpointed can be deal-breakers for many borrowers and their families.

The application

A first disadvantage of opting for a Discovery student loan is the necessity of a hard credit check. This can hurt both the borrower and the co-signer and bring their respective credit scores down slightly,

The loan

While it's advised that most student borrowers have a co-signer, Discover makes it hard for those co-signers to be released. In most cased, co-signers are tied to the loan for the entirety of the life of the loan, making Discover student loans unsuitable for many students whose co-signers would want to eventually be released.

While Discover student loan fixed rates are competitive, their variable rates are quite high compared to the norm, and can reach up to nearly 13% APR. For those who prefer to gamble with their luck, this may still be too high compared to the variable rates of other lenders.

Repayment

There is generally only one loan term possible, dependent on the type of degree you are borrowing for. This is highly inconvenient for both those who opt for the minimum amount for a loan and those who opt for a loan that covers all school expenses. For undergraduates, for example, this means having to pay $1000 up to upwards of $45,000 a year over the course of 15 years.

Qualification highlights: How to qualify for a Discover student loan

Qualifying for Discover student loans is fairly easy. Eligibility is dependent on the following:

- Being enrolled at least half-time in an eligible institution

- Seeking a degree

- Progressing in a satisfactory way as determined by your school

- Being a US citizen, permanent resident, or international student with a co-signer who is either a US citizen or permanent resident

- Being at least 16 years of age at the time the application is submitted

- Passing a credit check

If you are applying for a Discover Residency Loan or a Discover Bar Exam Loan, there are additional requirements that are clearly outlined on Discover's website.

Applying for a Discover student loan

According to Discover, it can take as little as 15 minutes to apply for a Discover student loan, making it a more attractive option than a loan that requires a lengthy application and approval process. However, if you are the co-signer, it may take a little longer, even if you have the necessary information handy, such as financial information, including mortgage or rent payments. Otherwise, the Discover student loans application is fairly straightforward and simple.

Discover Student Loans: User experience and customer service

Many Discover student loan borrowers seem very pleased with their loan experience. Many happy customers benefit from the Good Grades Rewards program, and express satisfaction with customer service.

However, the main complaint borrowers have is the high interest rate applied to their student loans. High interest rates can add thousands, even tens of thousands of dollars to your original loan amount. Some customers also report that it can take a few weeks to get approved for a loan, and others report being dissatisfied with co-signer requirements.

While positive and negative customer reviews can help you decide whether or not to opt for a service. it's important to remember that no student loan service is perfect: steps like approval and disbursement are subject to human error, and highly negative experiences can be due to sequences of human error.

Discover Student Loans: What happens if I can't pay my student loan?

Unlike many student loan providers, Discover is relatively clear about its dedication to working with its borrowers in the event that they cannot pay their student loans. For every type of degree that can be earned with a Discover student loan, there is a section addressing what borrowers can do if they cannot make their payments.

The caveat with that is that Discover doesn't clearly delineate a borrower's options in that section and simply lists the number for the Repayment Assistance Department. While this may not seem encouraging, it is generally a challenge to find any kind of mention of payment deferment on a private lender's website.

After some digging, we've found Discover's more in-depth table of deferment options and a borrower's eligibility. You can find the table on Discover's student loans site. The good news is that Discover appears to have more forbearance and deferment options than most lenders.

What type of borrower is a Discover student loan best for?

While Discover student loans seem like they can be a good fit for almost any student, we recommend that only borrowers with stable relationships with their co-signers apply for a Discover student loan, simply because co-signers are tied to the loan for the entire life of the loan. We also recommend that motivated students strongly consider a Discover student loan thanks to the Good Grades Rewards program.

Discover student loans versus federal student loans

While Discover student loans are a worthy choice for any borrower, we highly recommend that student explore their federal student loan options before considering any private lender. Federal student loans have perks that private lenders either cannot or are reluctant to offer borrowers. Read more about the FAFSA and federal student loans by checking out our FAFSA review.

That being said, if you maxed out the amount the federal government can lend you and still need financial assistance, Discover is a worthy choice for private student loans. If you feel comfortable opting for some of Discover's more restrictive loan requirements and have a willing co-signer with great credit, then Discover may be for you.

Discover Student Loans: Verdict

Overall, we think that Discover is a relatively good choice for a private student loan lender provided that you or your co-signer have worthy credit. We especially like how transparent Discover is about its loan offerings, which can allow borrowers to feel more confident in their choice. Discover clearly highlights how it compares to other lender like Wells Fargo and Sallie Mae, and in those highlighted sections, Discover clearly wins out. However, if you're a borrower or a co-signer, you may want to do a little more research (which includes reading this review) to see where Discover falls short and how that may affect you.