Amica Auto Insurance: What you need to know

Amica Auto insurance is an old-timer in the world of mutual auto insurance, the oldest apparently, having been started in 1907 in Rhode Island. It's since gone national but still hasn't grown to the scale of the competition like Allstate or State Farm. But this appears to be a good thing as the customer retention rate is about 95% and the average complaint rate is lower than the national.

The idea is to offer a personal service with lots of flexibility which is achieved through direct contact with Amica representatives, rather than insurance agents.

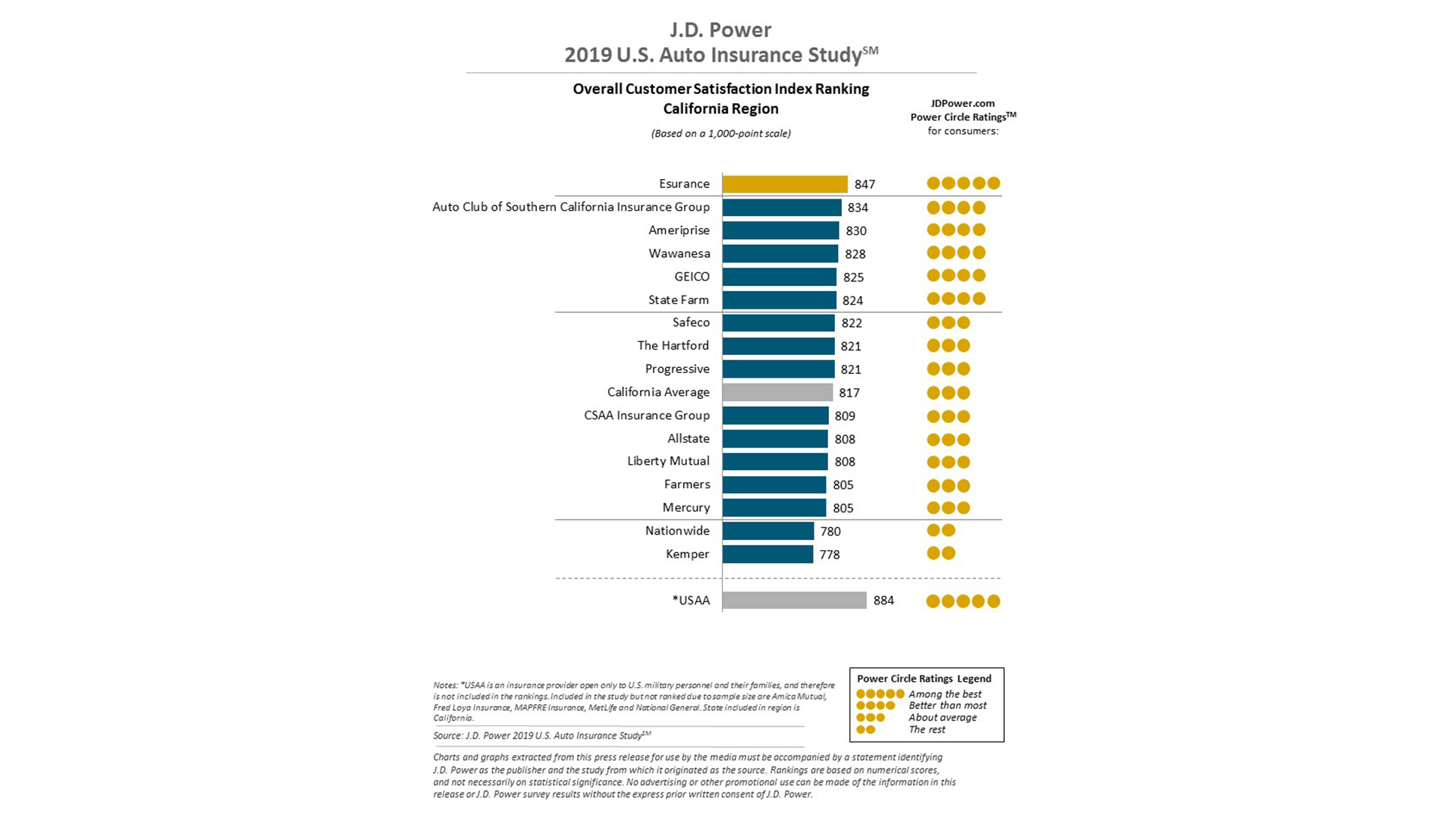

This appears to have been achieved as the JD Power 2018 results found that on both customer satisfaction and claims satisfaction surveys Amica scored higher across the board than any other auto insurer.

Aside from the excellent customer service and flexible billing plans, other positives offered are online policy management for small changes and 24/7 customer care.

There are also lots of discounts available ranging from anti-theft and restraint system offers to auto pay and homeowner discounts and plenty more in between. That'll be the flexibility that Amica talks about then.

Covering 50 states plus Washington D.C. the A++ superior rated service offers both comprehensive and collision coverage. There's also gap insurance which is ideal for those still paying off their car loan.

Policies: How much does Amica Auto Insurance cost?

- Quotes well below average, whether you're young or old, male or female

- Huge selection of discount options

Airbag repair: Free airbag repair if it goes off

Free lock replacement: Get your lock replaced for free if you lose your keys or if they're stolen

Accident forgiveness: Depreciation won't be taken into account if your car is totaled in the first year of ownership

While policy options vary at the best of times this is even more so with Amica thanks to that flexibility and huge selection of discount options. As such, giving you a price is difficult.

That said, when compared to the competition Amica does well. For example a quote for a 22-year-old single male came in at $987, compared to $1,373 for Allstate and $1,911 for State Farm, although Geico was lower at $815.

For a 25-year-old single female Amica was $893, with Geico lower at $790 but Allstate higher at $1,153 and State Farm the most expensive at $1,204.

For a late twenties married couple Amica charged $878 while Geico was $788, Allstate $1,049 and State Farm $1,156.

Amica Auto Insurance: Discounts

- Excellent selection of discounts

- Plenty of policy options

Amica is one of the best, if not the best, auto insurers when it come to discounts with lots of options available. Policy discounts include money off for:

- Multi-line – if auto insurance is bundled with another offering from Amica

- Claim-free – three years of no claims gets a discount

- Multiple auto – more than one car on the same policy

- Loyalty – stay with Amica for more than two years

- Paid in full – pay your entire premium before the first bill is due

- Auto pay – set your account up to bill you automatically

- E-discount – get your bills and information online rather than mail

The discounts don't stop there, you also get ones for your vehicle specifically. These are:

- Anti-theft – get an anti-theft device installed in your car

- Electronic stability – save if you car has an electronic stability feature

- Passive restraint – get a discount if your car has airbags

- Forward-collision warning – save if your car helps you avoid crashes

- Adaptive headlights – headlights that adapt to the light can save you money

Amica Auto Insurance: Free rewards

- Covered to have your airbag repaired, if it ever deploys, for free

- Glass replacement won't stand against your no claims discount

The freebies when you sign-up to Amica are plentiful. For a start you'll be covered to have your airbag repaired, if it ever deploys, for free.

If you lose your keys, or have them stolen, you can claim a free lock replacement on Amica.

If your glass needs a repair you won't need to worry as that won't stand against your no claims bonus. Also you pay no deductible for the service at the time either.

If the worst happens and you end up going to court then Amica will fully cover you for any lost earnings from your missed work during that time.

Amica Auto Insurance: Rewards and fraud monitoring

- Offers Fraud monitoring

- Rental car reimbursement

Amica shows that it's in this for the long-term with services like fraud monitoring and advantage rewards.

The advantage rewards are attained by letting you earn points for good driving, time with the company or for adding new customers or adding other policies. These points can then be spent on things like accidental forgiveness to prevent a price increase if you have an accident, or to pay down the deductible.

There is also a 24/7 fraud-monitoring service which monitors three major credit bureaus. You also have access to a fraud specialist should your identity be stolen.

Another reward of sorts comes in the form of rental car payments with up to $5000 given towards a car rental of a comparable car if yours is in an accident.

Amica Auto Insurance: Repair anywhere

- You can go to wherever is most convenient to you for repairs

- Amica does have a list of recommended facilities

Most insurance companies dictate where you need to take your car should it need work but Amica is different. That means that if you get in an accident you can go to wherever is most convenient to you.

You might think that means you can take this to your buddy, and you can if you want. Amica does have a list of recommended facilities for those who want it but essentially you're free to pick where you want.

Amica Auto Insurance: User Reviews

- 5 star rating overall from J.D. Power

- 2 star rating from ConsumerAffairs

Amica is a local focused service that has moved onto the national scale. It's apparently done this well as it's getting very good ratings across the review platforms.

According to the 2018 J.D. Power study, for customer satisfaction and claims satisfaction Amica was rated as one of the best services in the country.

ConsumerAffairs gives far fewer ratings for this company but of the few it's mainly complaints. This is odd since as a company it has a low level of complaints in comparison to the average. Most complaints stem from advertised potential savings not being matched when a quote is made rate increases over the years.

Amica Auto Insurance: Verdict

Amica Auto insurance is one of the most highly rated in the country when it comes to customer satisfaction. This is likely not only thanks to great customer service, with an Amica representative available to help, but also thanks to superb discounts and masses of flexibility. The freebies like glass replacement and airbag repairs are top positives as is the ability to pick your garage of choice when getting repairs.

The lack of digital information available may be a negative for some but with human help available when you need it this appears to keep most people happy – 95 percent customer retention appears to say so anyway.